What Does a Basic Invoice Look Like?

A basic invoice contains a number of essential information, which makes it a valid document for transactions. Without these contents, an invoice may be considered invalid. Therefore, it is important for you to know how a basic invoice looks like.

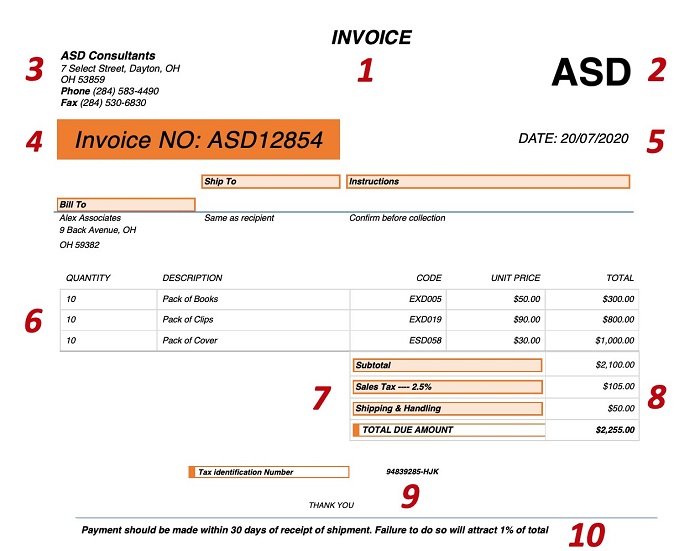

The snapshot below demonstrates how a basic invoice may look like.

In essence, an invoice is divided into three main parts. These parts are the header, the main body, and the footer. Each section usually contains a specific type of information or element.

Header

The invoice header is found at the top of the documents. It may usually contain several pieces of information. Looking at the invoice from above, you can see three elements within the header.

Item number 1 is the heading of the document. It is usually the name of the document. In this case, the name of the document is “invoice.” Item 2 is the logo of the company. On the other hand, item 3 is the service provider’s name, contact address, and contact information. All these elements can be presented in a variety of ways.

Main Body

The main body of an invoice may contain a lot of elements and information. The invoice above includes a total of 6 items. However, this number is not set in stone. It could vary depending on the service provider and the type of invoice.

Items number 5 and 6 are invoice issue date and the invoice number. These elements are usually provided just below the header. Item 6 is a description of the items and services offered by the service provider to the client. Usually, this element contains the quantity, description, unit price, and total price per item. Some service providers may assign codes to each item, as was done in the sample above.

Element number 7 constitutes a number of items, which include subtotal, handling and shipping, and taxes. These items form the total due amount, which is item number 8.

Item number 7 is usually the comment or message section of the invoice. The service provider may decide to input any information within this section. From the sample invoice above, you can see the company’s tax identification number and a “thank you” message.

Footer

The footer of an invoice is the last section of an invoice. It is located at the bottom of the document. Most service providers like to include legal information or any information that may relate to delay in payment. For example, a service provider may include within the footer the due date for payment and the penalty for late payment, as shown in the sample invoice. However, like all other elements, a service provider may decide to include more or less information as needed.

Should I Issue a Paper Invoice or a Digital Invoice?

As a business entity, you issue an invoice after making a sale to keep track of taxes, inventory, and accounting purposes. Most entities issue an invoice and expect to receive the payment later. Most businesses now use their accounting software to issue invoices.

And even when they issue a paper invoice, they do make a point of creating a digital copy for filing. Most tax jurisdictions require businesses to keep copies of their invoices for at least five years after a sale has occurred. Invoices can be useful when carrying out audits.

To a seller, an invoice is a sales invoice, while to a buyer, an invoice is a purchase invoice. However, it is the same document, and it bears the same details but with different meanings to the buyer and seller.

Once an invoice is paid and a receipt issued, the buyer can retain it as proof of ownership.

What is an Invoice Number?

Out of the ten basic entries of an invoice, the invoice number is the most important in accounting for both the buyer and seller. It uniquely identifies that invoice, and it is connected to the purchase order.

While a seller can generate an invoice number to their preference, the standard practice is to make it sequential. However, most businesses will add a prefix to the sequence to denote the client or service described in the invoice.

For instance, a business can have its invoices for “client X,” starting with “CLTX.” That would lead to invoice numbers CLTX001, CLTX002, and so on. Overall, the best system does not confuse the client or the auditors.

Why are Invoices Important for Online Businesses?

An invoice is an important document for an online business because it helps a business to justify its income and payments received. Most payment processors such as PayPal and Stripe could withhold earnings if no invoice was issued.

That’s because most online scams involve billing a client without invoicing. But with an invoice, a payment processor can establish with ease if a scam is ongoing.

And for tax purposes, an invoice can be used to show how much the income is taxable or if the expense in the invoice is tax-deductible. Overall, with an invoice and delivery notes, it is easy to create a paper trail of your income.

When is the Best Time to Invoice a Client?

Most online businesses prefer to invoice first and then deliver the service later. That allows them to secure the payment from remote clients. This works well because payment processors offer clients refunds if they don’t receive their goods or services.

Summary

A standard invoice usually has a familiar setup, which consists of a header, main body, and a footer. Within each section, a number of elements are written. However, the type of invoice and the type of company determines how the elements on an invoice are presented.

Other useful articles:

- What are Different Types of Invoices

- What Does a Basic Invoice Look Like

- Main Invoice Contents and Where Do We Use Them

- Is Invoice and Bill - the Same Thing

- How Does Electronic Invoicing Work

- How to Calculate Invoices

- Which is of More Importance? Bill, Invoice, or Purchase Order?

- What Basic Information is Needed on Purchase Order?

- Method of Using Purchase Order and Why Purchase Order Is Important

- Invoice Types and Requirements in Brazil

- Invoice Types and Requirements in Chile

- Invoice Types and Requirements in Korea

- Invoice Types and Requirements in England

- How to Keep Track of Invoices and Payments

- GST Invoice Guide