How to Calculate Invoices

An invoice is a financial document created by a seller and sent to a buyer for payment of purchased goods or services. Before the creation of an invoice, the actual figures within the invoice must be calculated.

This calculation can be done using various methods. The most common method for analyzing an invoice is through a spreadsheet (Microsoft Excel or Google Sheets). In this method, a series of formulas are used to automated the calculation of the invoice. Each cell within the spreadsheet table is carefully filled to ensure accuracy as once a mistake is made, the entire outcome will be wrong.

An invoice can also be calculated using specialized accounting software applications. Such applications can be expensive but are significantly accurate. Therefore, those companies that can afford such software should go-ahead to use such applications.

Nonetheless, whatever method is used for the calculation of invoices, the process is similar.

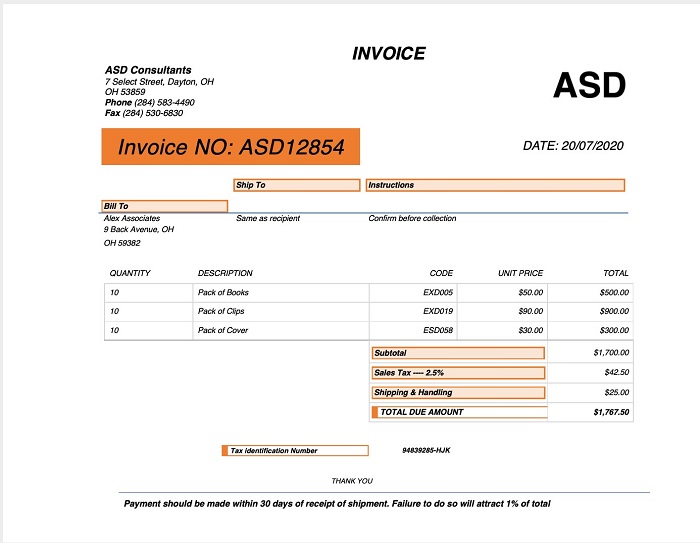

From the snapshot above, the most important elements for calculating an invoice are quantity, unit price, total, subtotals, deductibles, and additives. All these are used to generate the total due amount.

Quantity

The quantity of items specifies the number per item. For example, in the snapshot above, the pack of books, the pack of clips, and the cover pack are 10 in number each.

Unit Price

The unit price of each item is also used to calculate an invoice. From the snapshot above, $50, $90, and $30 are the costs of the pack of books, the pack of clips, and the pack of cover, respectively.

Deductibles

Deductibles are amounts included after the calculation of the subtotal. A typical deductible reduces the total amount due on an invoice. An example of a deductible is a discount or a refund, deducted from the total amount. From the snapshot above, for this particular invoice, there are no deductibles.

Additives

Additives are elements, which are also included after the calculation of the subtotal. A typical additive increases the total amount due on an invoice. Typical examples of additives are shipment and handling charges and taxes (sales tax and import). From the snapshot above, it is clear that both shipment and handling charges and sales tax are added to the subtotal, which increases the total amount due.

Calculation

Calculating an invoice is a simple and straightforward process. For simplicity, a simple manual calculation will be demonstrated. The quantities and the unit price per item are multiplied to calculate the figures under the total column.

For example, for the pack of books, 10 is multiplied by $50, which gives $500. The same calculation is carried out for the remaining items, which gives $900 and $300.

$500, $900, and $300 are summed up to give a subtotal of $1,700.

Next, the sales tax is calculated as 2.5% of the subtotal, which is $42.5. On the other hand, shipment, and handling equal to $25. Therefore, the subtotal ($1,700), sales tax ($42.5), and shipment and handling ($25) are added up to give a total due amount of $1,767.50.

How to Calculate Invoices – Frequently Asked Questions

How do you calculate a prorated invoice?

You can calculate a prorated invoice amount by dividing the monthly invoice, by the number of days of that month, and then multiplying the result by the number of days invoiced. For instance, if the invoice for the month of April is $100, divide that figure by 30.

You will get $3.33 per day. And if the client used the service for 20 days, you can multiply that figure by 20 to get $66.6 for that period. Using a prorated invoice allows the customer to pay a fair amount for services used each month.

How do you calculate the invoice-processing costs?

The simplest approach is to get an average cost of processing an invoice for your Accounts Payable department in a particular period. First, calculate the total expenses they incurred for all invoices. Then divide the result by the total number of invoices processed for that period.

That will give the average cost of processing a single invoice. However, you will find that some invoices will have numerous items, and supporting documents. Those can take longer to process, compared to those that have fewer details.

However, you can lower the overall cost of processing an invoice by automating the process. Technologies such as RPA can short bulk invoice processing times and save you hundreds of dollars in human equivalent work hours.

How much does it cost to process an invoice manually?

The cost depends on whether you are using a paper invoice or an electronic invoice. Paper invoices can cost between $10 to $30 to create and process. The cost can be as high as $40 if the invoice has a complex accounts payable process.

How much do invoices cost? – Automated Invoicing

However, companies with invoice automation software can spend as little as $3.50 on average per invoice process. Apart from the actual dollar savings, their staff tends to be happier as they spend less time handling the exhausting manual process of paper invoicing.

Is pro-rata the same as prorated?

The words “pro-rata” and “prorated” mean to assign a value in a proportionate manner. Pro-rata translates to “in proportion” in Latin. When used to refer to something, it means that whatever is being referred to as pro-rata or prorate has been divided into equivalent portions.

Using pro-rata to allocate funds means individuals receive payments based on their share of a whole amount, property, or income.

Other useful articles:

- What are Different Types of Invoices

- What Does a Basic Invoice Look Like

- Main Invoice Contents and Where Do We Use Them

- Is Invoice and Bill - the Same Thing

- How Does Electronic Invoicing Work

- How to Calculate Invoices

- Which is of More Importance? Bill, Invoice, or Purchase Order?

- What Basic Information is Needed on Purchase Order?

- Method of Using Purchase Order and Why Purchase Order Is Important

- Invoice Types and Requirements in Brazil

- Invoice Types and Requirements in Chile

- Invoice Types and Requirements in Korea

- Invoice Types and Requirements in England

- How to Keep Track of Invoices and Payments

- GST Invoice Guide